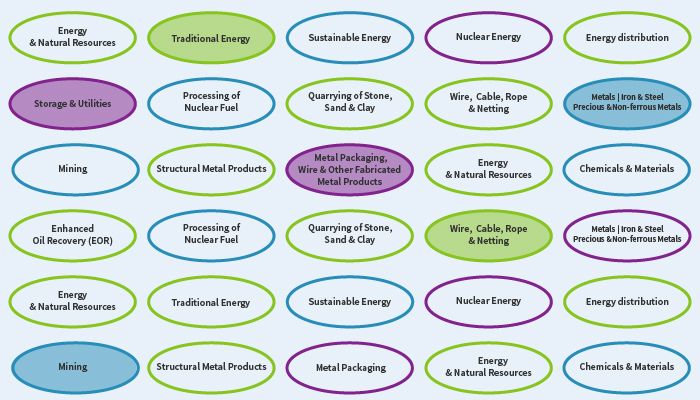

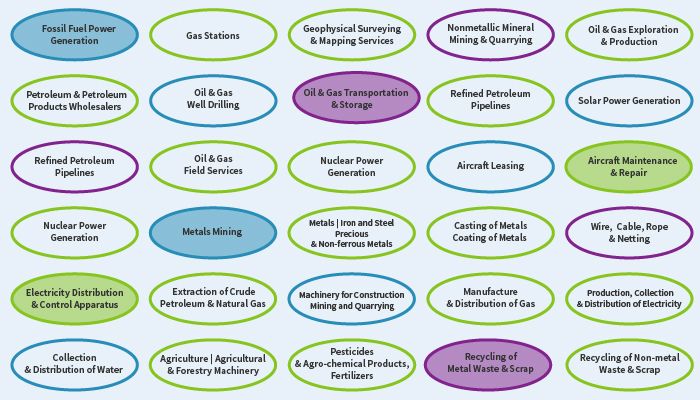

This research category provides facts and data about energy and natural resources, reserves, production, and consumption, supply and demand of the most important energy resources, metals and minerals, utilities and power, environmental issues and technology.

The energy industry is crucial to the global economy as it is essential to modern society.

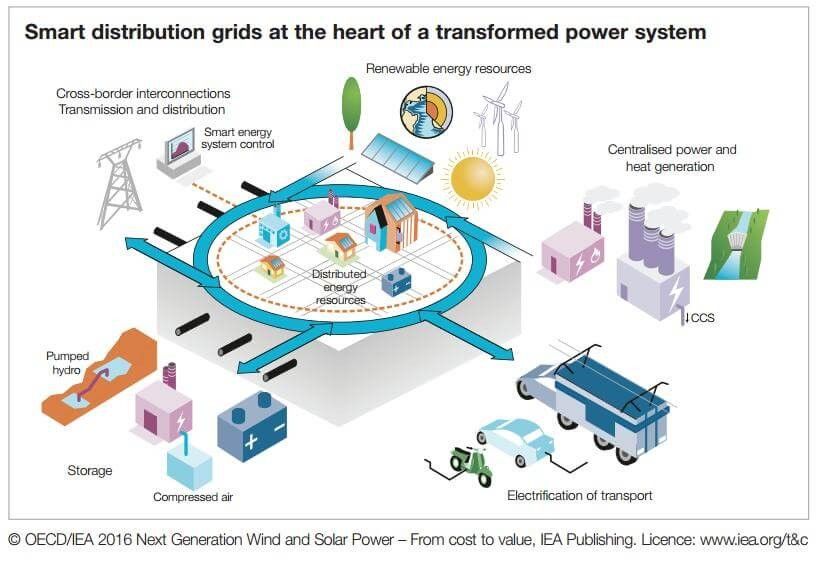

It is estimated that over 200bn USD of investment in energy infrastructure will be needed by 2025, with projects to be delivered by an indeterminable workforce due to a lack of skill and experience in either the renewable energy or nuclear energy sectors.

The power and utilities sectors are heavily driven by regulation and in some cases government is driving market demand. The potential for government to have an impact is therefore very high – for example, through procurement policy, measures to reduce market uncertainty, and demonstration projects. Clearly these enabling sectors are areas where a strategic partnership with government is likely to be highly beneficial to the growth agenda.

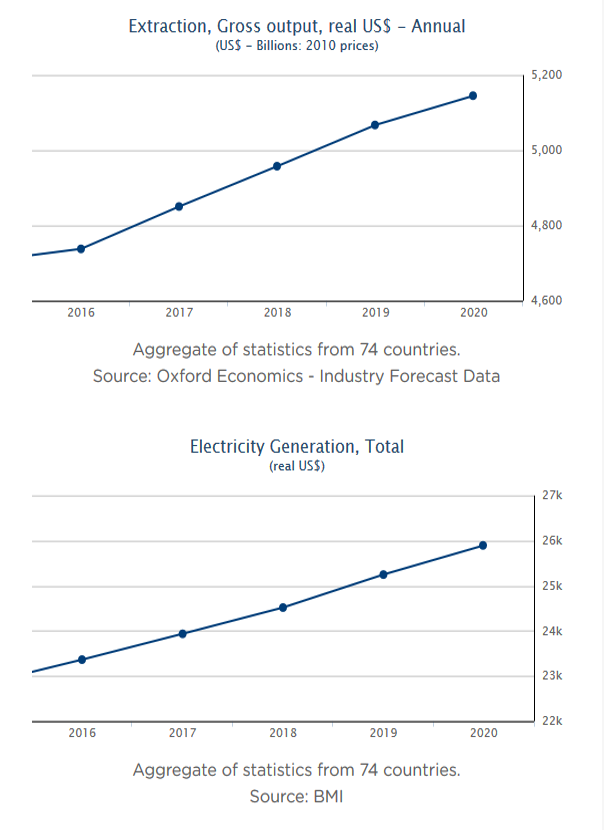

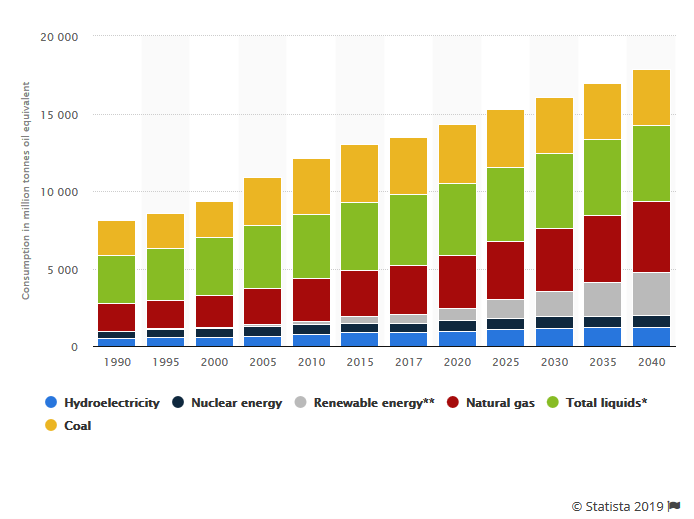

Global demand for energy is constantly rising

According to the International Energy Agency, demand for energy is expected to increase by approximately 50% by 2030.

As currently, fossil fuels account for more than 80% of demand for primary energy, and whose reserves are being depleted, new sources of renewable energy are being sought to cope up with the rise in demand for energy.

The global economy is set to grow rapidly in the coming years. While this promises a better living standard and several economic benefits, it is indicative of an exponential rise in the use of energy.

Given this scenario, governments are concerned that the increasing energy demand will place unsustainable pressure on natural resources, and to halt the indiscriminate use of natural resources, have imposed stringent regulations.

Besides this, prevailing energy prices and changes in technology are challenging for the energy and natural resources sector.

Increasing population, rising standards of living and expanding industrialism have necessitated an increase in power supply. The demand has been increasing across industrial, commercial and residential consumers.

Till now, fossil fuels have represented the primary source of energy worldwide, with some 80 percent of the global energy supply still coming from fossil fuel resources – crude oil, natural gas, and coal. Fossil fuels, on the other hand, are a main cause for some of the world’s urgent problems – climate change and global warming.

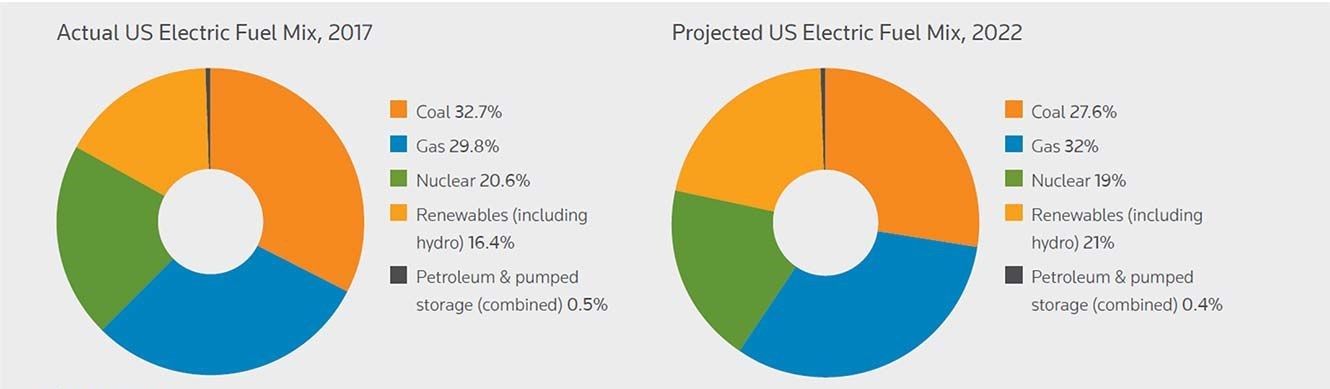

Thus, to cope up with the rising demand, the energy & power industry is shifting from coal to alternative sources such as shale gas and natural gas, and moving towards distributed generation and alternative energy sources.

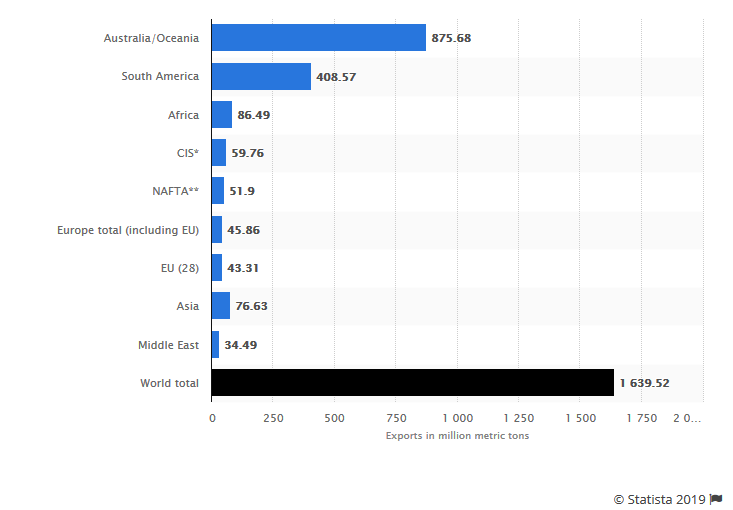

Moreover, favourable government regulations in most of the emerging nations are anticipated to boost the adoption of renewable energy sources in countries such as India, Japan, Australia, and China, which are expected to drive future growth.

Given the increasing “go green” pressure on industries to cut their carbon emissions, major transitions are destined for the energy and resources.

While renewable energy accounts only 15% market share, is expected to undergo large transformation in coming decades.

Projected global energy consumption from 1990 to 2040, by energy source (in million metric tons of oil equivalent)

Climate change has become an utmost priority for all the countries with many of them having recently announced targets toward energy-efficient improvements and upgrades.

The Climate Deal signed in 2015 by nearly 90% of the countries, worldwide, needs investments amounting to tens of trillions of dollars by 2040 to achieve the set objectives.

The trend towards tougher environmental standards and the likely increase in international agreements will drive demand for low carbon goods and services, including green energy generation.

Generation from renewables, including wind, wave and tidal, currently makes up around 15% of the UK’s electricity supply. The largest contributor to this is the combination of on-shore and off-shore wind power. The UK has made a firm commitment to cut carbon emissions by at least 80% by 2050. Between 2010 and 2020, the UK is expected to cut greenhouse emissions by 29%, and must reduce this amount by a further 85% by 2030.

Renewable energy includes solar, bioenergy, geothermal, hydro, tidal and wind. And non-renewable energy sources include petroleum, coal, lignite,natural gas and nuclear.

It is estimated that global energy consumption from renewable sources will be around 2.7 billion metric tons of oil equivalent in 2040.

Clean, renewable solar and wind energy are expected to go cheaper along with a significant rise in the market share, while at the same time, the demand for resources like oil and gas are envisaged for slower growth, due to increased fuel efficiency innovations in the automotive industry.

Decreasing costs, continued research in technology improvements, and new sources of financing will continue opening up opportunities in the Clean and Renewable Energy Markets.

Despite the rising demand for energy derived from renewable sources, the market is limited by the high cost of renewable energy. Nonetheless, the renewable energy sector is reporting steady growth.

Permanent magnet market

Energy generation, electronics, automotive are driving growth of the permanent magnet market. According to Global Market Insights, it is estimated to surpass a revenue of USD 50 billion by 2024, registering an annual growth rate of more than 10% over the period of 2016 to 2024.

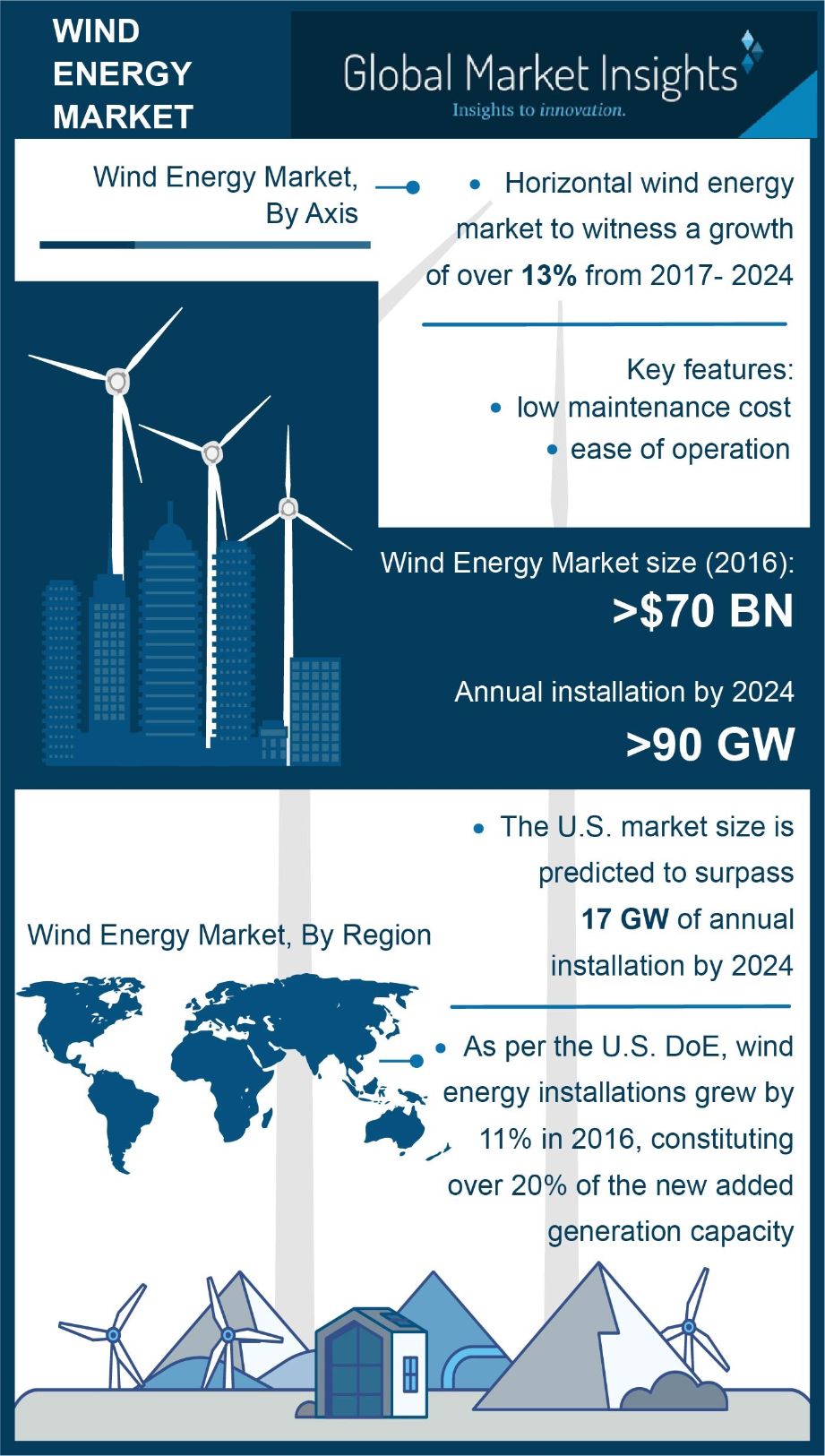

AS per the study by Global Wind Energy Council (GWEC), annual installation of the windmill will increase over 75GW capacity by 2019, which will boost the demand for global permanent magnet industry significantly. Moreover, UNFCCC’s Cop 21 announced that, by 2050 all power generation should be emission free, which will fuel the requirement of wind energy projects and impact the permanent magnet market. Furthermore, rising R&D investment to develop new and superior quality magnetic material is expected to boost market demand.

We deliver insights covering the renewable energy spectrum, from solar and wind energy to energy storage technologies, fuel cells, and the permanent magnet market.

Energy and Natural Resources

Energy and Natural Resources