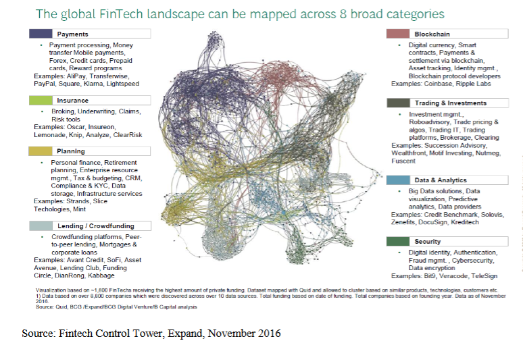

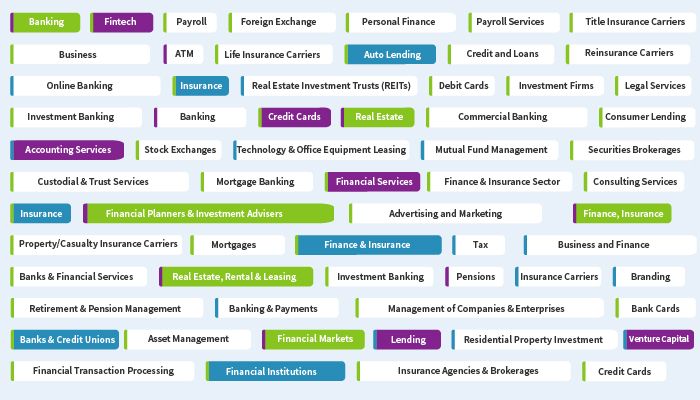

The financial services market involves financial services related activities such as lending, investment management, insurance, brokerages, payments and transferring service. Financial services institutions are made up of organizations such as banks, building societies, trust companies, credit unions, insurance companies and investment dealers. Acting as intermediaries between savers and borrowers, are ensuring that funds are allocated efficiently; support of payment and settlement systems that facilitate international trade. The industry also encompasses a broad range of other industries including credit card companies, credit unions, accountancy companies, investment funds and brokerage of stock and investment funds. It also includes insurers, re-insurers, underwriters and insurance brokerages, pension funds, health and welfare funds, monetary authorities, stock exchanges, and collection and credit agencies. From equities and bonds, to currencies and derivatives, and the mechanisms of forward and futures contracts, financing through the issuance of shares, and finance through the issuance of bonds.

Financial Services

Financial Services