The Connected Consumers today are seeking a brand experience that delivers maximum convenience and safety, and being fully equiped with tech gadgets, navigation systems, IoT-enabled parking sensors, automatic lights, windscreen wipers, and infotainment systems.

Technology is pushing the automotive industry to new directions with hybrid autonomous and electric vehicles, with technologies such as telematics and advanced driver assistance systems (ADAS), and automobile manufacturers are forced to update their product portfolios.

Artificial Intelligence (AI) is driving transformation in the automotive and transport industry paving way for the integration of advanced navigation systems and parking sensors with automotive technology.

Advanced Technologies & Automotive Systems

New technological changes in engine and exhaust systems, such as Turbocharged Direct Injection (TDI), Variable Valve Timing (VVT), and Common Rail Direct Fuel Injection (CRDI) are being used to improve fuel efficiency, better emission standards, enhanced vehicle performance, as well as reduce engine weight and engine size.

Smart electronics installed in modern cars is expected to increase across safety, infotainment, comfort and engine control. Also for the introduction of features in vehicle interior that make for a great driving experience.

Innovation and technologies are transforming the future of the automotive industry. Telematics, cloud computing, IoT, smart applications, artificial intelligence, cloud-based services, connectivity, smartphone’s integration, telematics, 3D printing, V2V, V2I technologies, wireless communication, and many more high-tech applications are revolutionizing the complete automotive ecosystem.

The industry is witnessing rapid changes owing to continuous innovations in materials used such as alloys, light weight metals, fiber, plastics, and composites.

Major automotive systems includes fuel system, exhaust system, transmission system, suspension system, cooling system, electrical system, and braking system.

Innovative manufacturing technologies have supported the transformation for automotive components and materials due to the stricter emission norms and improvement in vehicle performance, safety and engine efficiency.

Consumer preference and regulatory safety requirements is driving the market for innovative and high-tech solutions for both driving support and safety systems. Connected car, V2V, and V2I will play a key role in accident prevention, driving comfort, and enhanced safety. Traffic sign recognition, lane departure warning, blind spot detection, night vision systems, and other technologies are expected to increase in the near future.

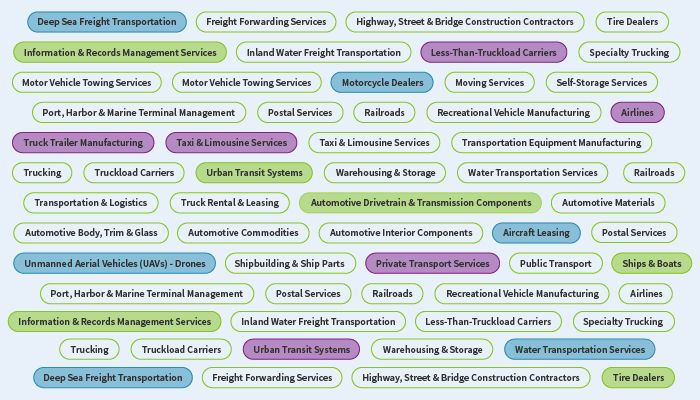

Our reports offer insights on drivers, challenges and opportunities, covering the impact of industry standards, environment regulations, and other factors impacting market growth, as well as the components and materials value chain.

Reports highlight evolution such as hybrid and electric vehicles, driverless, connected cars, the shift towards alternative fuels and emission control technologies.

The Automotive Industry

The Automotive Industry