5 practices that offer the strength of a company's employer brand

Dr. Evangelo Damigos; PhD | Head of Digital Futures Research Desk

- Competitive Differentiation

Publication | Update: Nov 2022

Employer branding (EB) is one of the most important disciplines of talent acquisition (TA). It is about the company's reputation as an employer. In other words, employer branding refers to how individuals view the company's values and work environment. Therefore, employer branding is everything a company does - intentionally or unintentionally - to promote its unique identity as an employer to current and potential employees.[1]

For almost 59 percent of companies, employer branding is one of the most important components of their HR strategy. It is therefore not surprising that virtually every company today invests in its employer brand. The most widespread employer branding activities to serve the purpose include:

· Planning, designing and implementing a well-defined employer branding plan

· Using social media to share employee testimonials and success stories;

· Managing employer review sites such as Glassdoor.

· Creating and managing enhanced profiles on job boards such as Indeed and Monster.

· Creating and promoting attractive job descriptions and job advertisements;

· Investing in the candidate experience during the application and selection process. ; and

· Participating in local career fairs and other career events.[2]

1. Test and Measure Employer Brand

Improving a company's employer brand is an ongoing process that can be difficult to quantify. But much like marketers test and analyze the performance of their campaigns, recruiters should also review their techniques. Companies often mistakenly think they have a solid employer brand. The key is to keep an eye on the most important recruiting metrics:

· Reviews and ratings

A company's reviews on review portals such as Comparably or Glassdoor are crucial because they are the first place many applicants visit to find out about the quality of the employer brand. Monitoring the reviews over time and finding recurring criticisms that could indicate a deeper problem in the company culture, is crucial.

· Retention rate

Employee retention is an important indicator of the quality of a company's employer brand, although employee turnover is fluid and unpredictable.

· Source of hire

A company needs to trace the source of each order to see which channels produce the most (and least) employees. This metric helps the company identify the most effective channels and where to direct its efforts.

· Employee satisfaction

A great employer brand requires a healthy culture and satisfied employees. Therefore, a company should measure employee satisfaction across all teams and departments. Employees can give open feedback about their experiences in anonymous surveys without fear of consequences.[3]

2. Know the Employer Value Proposition (EVP)

The combination of a company’s mission, values, culture, and employee feedback helps create its employer value proposition (EVP). The latter encapsulates everything the company offers employees, and it can be a powerful branding tool. Letting prospective and current employees know what they receive in exchange for their skills, experience, and hard work gives them a deep understanding of how their role contributes to the company’s overall growth plan and helps them more actively engage in their roles.

While EVP includes salary, to add more meaning to the EVP, also include:

· Career development (including career paths and ongoing education)

· Management style

· How employees are evaluated and promoted

· Volunteer opportunities

· Job security

· Flexibility

3. Have a Meaningful Onboarding Experience

Introduce induction procedures at all organizational levels that educate new employees on the key principles of the organization. This transition period should include information to help new employees adapt to the company culture and make it clear that their time and skills are valued by the company as a whole, not just its department. Provide opportunities for its employees to learn about the work of colleagues in other locations and departments to promote teamwork and achieve a common goal.[4]

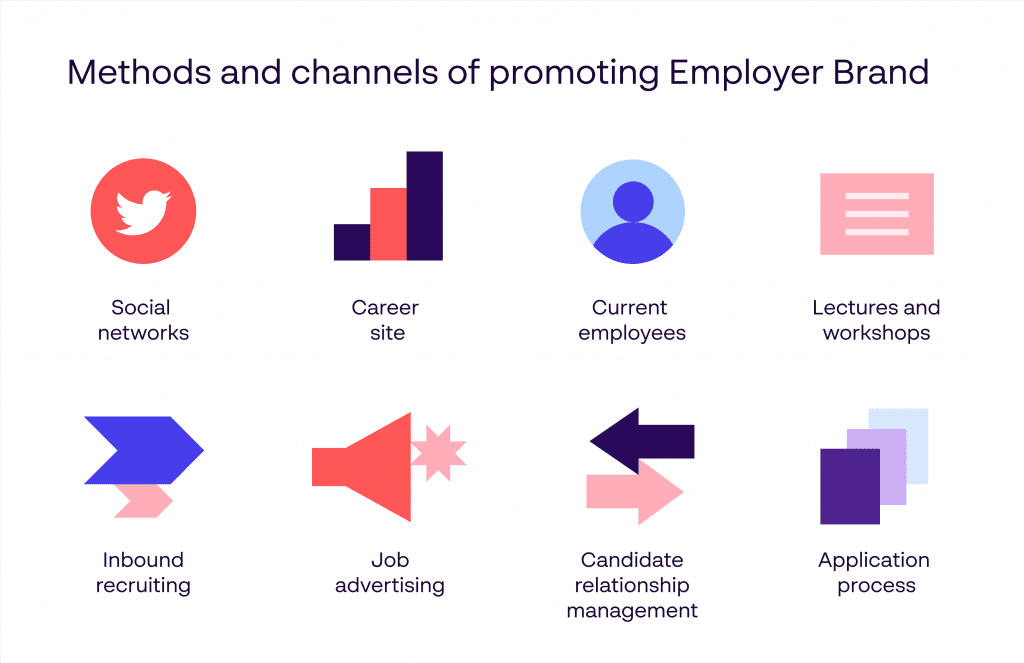

4. Determine and utilize primary marketing channels

As part of building its audience persona, a company should have a better understanding of which channels can be associated with the candidates it is looking for. Nevertheless, it is important that these channels are determined as part of the employer branding strategy and that consistency is maintained across all platforms used. By choosing the most effective channels, such as a careers page on the website, paid advertisements in the media or using social media for employer branding, the company can more effectively personalize and target its customers. Asking employees about their first experience with the brand can give useful insights as well as researching the most popular platforms and forums for industry experts. Once the company has determined which channels to use, it must use them to constantly communicate the inclusivity, vision and growth of its brand and employees. These photos, blogs, testimonials and other content shared through the target audience's most popular channels promote a clear understanding of the brand's values. However, it is crucial that the material does not feel forced or artificial. Authenticity is crucial to fully engage the target audience. Without this authenticity, people are likely to see through the company's attempts and distrust it in the future.[5]

Figure 1: Methods and channels of promoting Employer Brand. Papirfly. (2019, November). 13 steps to developing your employer branding strategy. Retrieved from: https://www.papirfly.com/blog/employer-branding/13-steps-to-developing-your-employer-branding-strategy/

5. Reduce Recruitment Costs

Due to increasing competition in the labor market, finding and hiring qualified candidates has become a costly endeavor. Posting jobs on various job platforms, working with recruitment agencies, searching for new employees, along with other measures, all incur costs. Developing a strong employer brand helps to reduce a company's recruitment costs. According to a study conducted by LinkedIn, companies that have a stronger employer brand than their competitors have 43 percent lower costs per new hire. With a strong employer brand, the company can spend less on advertising and marketing to increase brand awareness. For most job seekers, it is important to work for a well-known, reputable company. An organization that has a strong brand and reputation can be sure to attract top talents. Candidates will find the company and apply for a job even without its intervention. In addition, research shows that a number of applicants are willing to accept a lower income in exchange for working for a company with positive reviews and a well-established brand.[6]

[1] Workable Technology Limited. (2022, August). What is employer branding? Retrieved from: https://resources.workable.com/hr-terms/what-is-employer-branding

[2] Lankinen, A., Martic K. ((2022, October 26). Employer branding: 9 steps to build a successful strategy. Haiilo. Retrieved from: https://haiilo.com/blog/employer-branding-9-steps-to-build-successful-strategy/

[3] ZoomInfo Technologies LLC. (n.d.). 5 Ways to Build a Better Employer Brand. Retrieved from: https://pipeline.zoominfo.com/recruiting/employer-brand

[4] Pelta, R. (2021, November). How to build your employer brand in 10 steps. FlexJobs. Retrieved from: https://www.flexjobs.com/employer-blog/build-employer-brand-easy-steps/

[5] Papirfly. (2019, November). 13 steps to developing your employer branding strategy. Retrieved from: https://www.papirfly.com/blog/employer-branding/13-steps-to-developing-your-employer-branding-strategy/

[6] Employvision. (2022, September). Top reasons why employer branding Is essential in recruitment. Retrieved from: https://employvision.com/top-reasons-why-employer-branding-is-essential-in-recruitment/

Digital Themes: Competitive Differentiation

Digital Themes: Competitive Differentiation

HTML

Access Rights | Content Availability:

Access Rights | Content Availability:

Objectives and Study Scope

This study has assimilated knowledge and insight from business and subject-matter experts, and from a broad spectrum of market initiatives. Building on this research, the objectives of this market research report is to provide actionable intelligence on opportunities alongside the market size of various segments, as well as fact-based information on key factors influencing the market- growth drivers, industry-specific challenges and other critical issues in terms of detailed analysis and impact.

The report in its entirety provides a comprehensive overview of the current global condition, as well as notable opportunities and challenges.

The analysis reflects market size, latest trends, growth drivers, threats, opportunities, as well as key market segments. The study addresses market dynamics in several geographic segments along with market analysis for the current market environment and future scenario over the forecast period.

The report also segments the market into various categories based on the product, end user, application, type, and region.

The report also studies various growth drivers and restraints impacting the market, plus a comprehensive market and vendor landscape in addition to a SWOT analysis of the key players.

This analysis also examines the competitive landscape within each market. Market factors are assessed by examining barriers to entry and market opportunities. Strategies adopted by key players including recent developments, new product launches, merger and acquisitions, and other insightful updates are provided.

Research Process & Methodology

We leverage extensive primary research, our contact database, knowledge of companies and industry relationships, patent and academic journal searches, and Institutes and University associate links to frame a strong visibility in the markets and technologies we cover.

We draw on available data sources and methods to profile developments. We use computerised data mining methods and analytical techniques, including cluster and regression modelling, to identify patterns from publicly available online information on enterprise web sites.

Historical, qualitative and quantitative information is obtained principally from confidential and proprietary sources, professional network, annual reports, investor relationship presentations, and expert interviews, about key factors, such as recent trends in industry performance and identify factors underlying those trends - drivers, restraints, opportunities, and challenges influencing the growth of the market, for both, the supply and demand sides.

In addition to our own desk research, various secondary sources, such as Hoovers, Dun & Bradstreet, Bloomberg BusinessWeek, Statista, are referred to identify key players in the industry, supply chain and market size, percentage shares, splits, and breakdowns into segments and subsegments with respect to individual growth trends, prospects, and contribution to the total market.

Research Portfolio Sources:

Global Business Reviews, Research Papers, Commentary & Strategy Reports

M&A and Risk Management | Regulation

The future outlook “forecast” is based on a set of statistical methods such as regression analysis, industry specific drivers as well as analyst evaluations, as well as analysis of the trends that influence economic outcomes and business decision making.

The Global Economic Model is covering the political environment, the macroeconomic environment, market opportunities, policy towards free enterprise and competition, policy towards foreign investment, foreign trade and exchange controls, taxes,

financing, the labour market and infrastructure.

We aim update our market forecast to include the latest market developments and trends.

Review of independent forecasts for the main macroeconomic variables by the following organizations provide a holistic overview of the range of alternative opinions:

As a result, the reported forecasts derive from different forecasters and may not represent the view of any one forecaster over the whole of the forecast period. These projections provide an indication of what is, in our view most likely to happen, not what it will definitely happen.

Short- and medium-term forecasts are based on a “demand-side” forecasting framework, under the assumption that supply adjusts to meet demand either directly through changes in output or through the depletion of inventories.

Long-term projections rely on a supply-side framework, in which output is determined by the availability of labour and capital equipment and the growth in productivity.

Long-term growth prospects, are impacted by factors including the workforce capabilities, the openness of the economy to trade, the legal framework, fiscal policy, the degree of government regulation.

Direct contribution to GDP

The method for calculating the direct contribution of an industry to GDP, is to measure its ‘gross value added’ (GVA); that is, to calculate the difference between the industry’s total pretax revenue and its total boughtin costs (costs excluding wages and salaries).

Forecasts of GDP growth: GDP = CN+IN+GS+NEX

GDP growth estimates take into account:

Market Quantification

All relevant markets are quantified utilizing revenue figures for the forecast period. The Compound Annual Growth Rate (CAGR) within each segment is used to measure growth and to extrapolate data when figures are not publicly available.

Revenues

Our market segments reflect major categories and subcategories of the global market, followed by an analysis of statistical data covering national spending and international trade relations and patterns. Market values reflect revenues paid by the final customer / end user to vendors and service providers either directly or through distribution channels, excluding VAT. Local currencies are converted to USD using the yearly average exchange rates of local currencies to the USD for the respective year as provided by the IMF World Economic Outlook Database.

Industry Life Cycle Market Phase

Market phase is determined using factors in the Industry Life Cycle model. The adapted market phase definitions are as follows:

The Global Economic Model

The Global Economic Model brings together macroeconomic and sectoral forecasts for quantifying the key relationships.

The model is a hybrid statistical model that uses macroeconomic variables and inter-industry linkages to forecast sectoral output. The model is used to forecast not just output, but prices, wages, employment and investment. The principal variables driving the industry model are the components of final demand, which directly or indirectly determine the demand facing each industry. However, other macroeconomic assumptions — in particular exchange rates, as well as world commodity prices — also enter into the equation, as well as other industry specific factors that have been or are expected to impact.

Forecasts of GDP growth per capita based on these factors can then be combined with demographic projections to give forecasts for overall GDP growth.

Wherever possible, publicly available data from official sources are used for the latest available year. Qualitative indicators are normalised (on the basis of: Normalised x = (x - Min(x)) / (Max(x) - Min(x)) where Min(x) and Max(x) are, the lowest and highest values for any given indicator respectively) and then aggregated across categories to enable an overall comparison. The normalised value is then transformed into a positive number on a scale of 0 to 100. The weighting assigned to each indicator can be changed to reflect different assumptions about their relative importance.

The principal explanatory variable in each industry’s output equation is the Total Demand variable, encompassing exogenous macroeconomic assumptions, consumer spending and investment, and intermediate demand for goods and services by sectors of the economy for use as inputs in the production of their own goods and services.

Elasticities

Elasticity measures the response of one economic variable to a change in another economic variable, whether the good or service is demanded as an input into a final product or whether it is the final product, and provides insight into the proportional impact of different economic actions and policy decisions.

Demand elasticities measure the change in the quantity demanded of a particular good or service as a result of changes to other economic variables, such as its own price, the price of competing or complementary goods and services, income levels, taxes.

Demand elasticities can be influenced by several factors. Each of these factors, along with the specific characteristics of the product, will interact to determine its overall responsiveness of demand to changes in prices and incomes.

The individual characteristics of a good or service will have an impact, but there are also a number of general factors that will typically affect the sensitivity of demand, such as the availability of substitutes, whereby the elasticity is typically higher the greater the number of available substitutes, as consumers can easily switch between different products.

The degree of necessity. Luxury products and habit forming ones, typically have a higher elasticity.

Proportion of the budget consumed by the item. Products that consume a large portion of the

consumer’s budget tend to have greater elasticity.

Elasticities tend to be greater over the long run because consumers have more time to adjust their behaviour.

Finally, if the product or service is an input into a final product then the price elasticity will depend on the price elasticity of the final product, its cost share in the production costs, and the availability of substitutes for that good or service.

Prices

Prices are also forecast using an input-output framework. Input costs have two components; labour costs are driven by wages, while intermediate costs are computed as an input-output weighted aggregate of input sectors’ prices. Employment is a function of output and real sectoral wages, that are forecast as a function of whole economy growth in wages. Investment is forecast as a function of output and aggregate level business investment.

Industry: Services and Business Services

Industry: Services and Business Services